Adviser news & insights

-

29 Jan 2018

29 Jan 2018Why data, analysis and algorithms can resolve retirement contradictions

New approaches built on data, analysis and algorithms can help solve the contradictions of advising people who are effectively strangers to themselves.

-

24 Nov 2017

Portfolio strategy in a synchronised world growth & November review

Are double digit gains are a positive sign for traders and how to position your portfolio in a synchronised world growth environment.

-

10 Nov 2017

10 Nov 2017Exclusive interview: Charlie Aitken

As part of our partnership with Livewire, watch this exclusive interview of Charlie Aitken, CIO of AIM Funds. Charlie shares his views on how the investment landscape will evolve and how his fund is positioned, on both the long and the short side.

-

1 Nov 2017

Advisers: shape up or ship out

Now that managed accounts are on the scene, they are here to stay. For advisers still unsure about making the switch, now is the time to seriously consider the benefits or be sorely left behind.

-

27 Oct 2017

October: best performing month in 2017

Julia shares her insights on the current AGM season with the outlook statements in focus.

-

28 Sep 2017

28 Sep 2017The post-earnings announcement drift (PEAD) effect in September

Does the post-earnings announcement drift (PEAD) effect on the market hold true?

-

28 Sep 2017

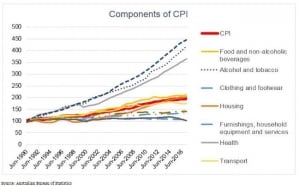

Should super funds use inflation as a benchmark for retiree returns?

Inflation is an important factor to consider in portfolio construction, but CPI is far from an accurate measure for retirees.

-

13 Sep 2017

13 Sep 2017How to avoid the ETF Trap

The popularity of exchange traded funds (ETFs) continues to grow at a rapid pace. Bell Direct CEO Arnie Selvarajah explains that there are several very good reasons for the rising appetite in ETFs.

-

28 Aug 2017

What we saw this reporting season

Julia Lee shares her insights on this earnings season, who the best and worst performers were, as well as an overview of the private health insurance and hospital area.

-

_300_200.jpg) 28 Aug 2017

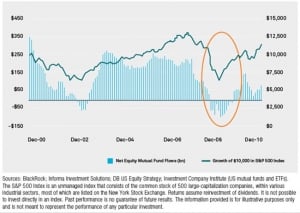

28 Aug 2017How to make rising rates your friend

Most of us expect that interest rates will rise at some stage, so here’s five questions investors considering bonds should be thinking about.

-

25 Jul 2017

What to expect this reporting season & July overview

Julia Lee shares her insights on the upcoming reporting season, from double vs. single digit growth expectations, companies in an upgrade cycle and potential gains from the most shorted stocks in the market.

-

_300_200.jpg) 21 Jul 2017

21 Jul 2017Why you should own your age in bonds

A rule of thumb coined by John Bogle, founder of global asset manager Vanguard, is that your bond allocation should roughly equal your age. While clearly not an exact science, it demonstrates the increasing need for fixed income as we move through life.