Retirees have good reason to be wary of rising inflation. It can quickly destroy the value of a lifetime’s savings and with it, their quality of life.

But that doesn’t mean inflation is an appropriate benchmark for super funds attempting to meet their members’ retirement needs.

Where retirees actually spend their money is only partially reflected in the components of the official Consumer Price Inflation (CPI) index. Yet more than half (59%) of all of balanced pension funds rank their performance against CPI, according to researcher SuperRatings.

How retirees’ expenditure differs from CPI

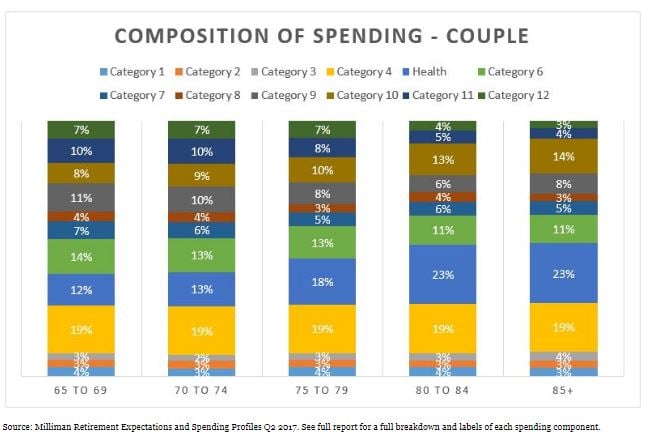

The following diagram breaks down retiree spending across 11 categories and five age bands, using real-world data to determine actual retiree behaviour rather than relying on limited, qualitative surveys and assumptions.

For example, health takes up 12% of 65- to 69-year-olds’ total expenditure, quickly rising to 23% of expenditure by the time they reach age 80 to age 84. Rising health costs may have a larger impact on retirees than the CPI would suggest.

Just as the impact of health costs increases as retirees age, their expenditure on travel and transport almost halves between the 65- to 69-year-old band and the 80- to 84-year-old band.

Meanwhile, other components given greater weighting in the CPI, such as housing and education, tend to account for a much lower proportion of retirees’ expenditure. We know that the majority of older Australians own their own homes, quarantining them from rising property prices, which is also reflected in the ESP data.

However, an estimated 15% of older Australians currently rent their homes, making significantly higher demands on their cost of living (partly because the value of homes doesn’t affect Age Pension eligibility), according to the latest census data.

The proportion of older renters is expected to increase as soaring east coast property prices lock more people out of the residential property market. The proportion of all people renting in Australia increased from 27% to 31% over the six years to 2016, according to the latest census data.

This shows that no measure is static–identifying trends and planning for their impact is a key challenge for funds but one that is only possible to meet with quality data.

Using this information to build better benchmarks

Inflation is an important factor to consider in portfolio construction, but the Milliman Retirement ESP shows that CPI is far from an accurate measure for retirees.

Getting it right is particularly important given that retirees are drawing down their life savings: small changes in expenditure (and investment returns) can have a significantly larger impact than on those still accumulating.

More accurate information about members can be used to create new benchmarks that suit retirees’ actual needs.

Some funds may wish to retain an inflation-based benchmark but reweight the components to reflect the real-world spending patterns of their retirees. This could be changed depending on the age of the retiree or retirement income streams could be constructed to meet discretionary versus essential spend.

Some funds may take this a step further and, given that CPI is not an investable asset itself, may replace CPI-based benchmarks altogether. An absolute return benchmark may give some retirees greater certainty and better meet their needs if funds can base those targets on granular data about real expenditure.

In this way, funds can create a personalised retirement journey for members and truly improve their retirement lifestyles.

The article was first published on Milliman website.

The full Milliman Retirement ESP report is published to subscribers each quarter. Contact Milliman senior consultant Jeff Gebler at jeff.gebler@millilman.com for more details.

Disclaimer

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.