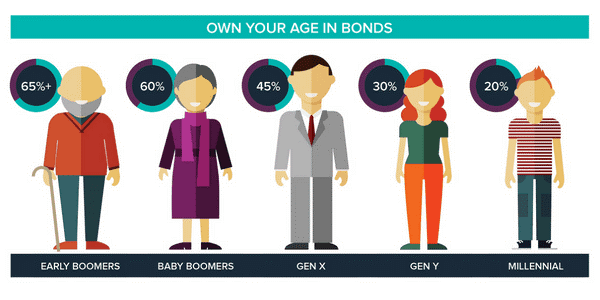

John Bogle’s rule of thumb suggests that 40 to 60 year old investors should have 40% to 60% of their portfolios in bonds, to create the predictability of income and stability of capital they will need.

The challenge for investors nearing the end of their earning capacity lies in creating predictable and regular income for when they retire - income that can weather difficult market conditions and meet the longevity test.

For younger investors who can absorb more risk - volatility can be your friend. If retirement is still 25 to 40 years away, you have time to recover from major losses. But that doesn’t mean you should bet everything on pure growth assets. Bogle would suggest you start creating a base of stable capital with 20% or 30% of assets in bonds, and slowly grow this over time.

For many investors currently in retirement, TD income has become their ‘salary’. Australian household deposits are now close to $900 billion dollars*, with a large part of this in TDs. They are popular because they offer capital stability and income predictability.

Shares – no longer the golden goose

Even for the most ardent share investor, it is clear the halcyon days of the 1990s and early 2000s are over. Recent dividend cuts are not one-offs. Australian share dividends are not guaranteed. The volatility of shares and the intermittent post-GFC series of shock-waves that cause fear and uncertainty every six months or so should not be overlooked.

It surprises some investors when they hear that sometimes total returns from bonds have beaten equities for a given calendar year. When things are going well for equities you get rewarded for taking on more risk. But when equities have a significant downturn, bonds generally do not. It isn’t about bonds versus equities, it’s about bonds and equities.

Term deposits – the search for stable income

Many investors have turned to TDs, which sit below shares on the risk return spectrum. The last annual report of just one of the four major banks showed they had over $200 billion in TD investments. However, all-time low rates are hampering the returns TDs can offer. The question to ask is: Is there a way to increase your yield from capital stable investments, without jumping onto the equity or hybrid rollercoaster?

Corporate bonds are worth a look

Fixed income investments are generally with more secure and capital stable investments than shares, hybrids, property and other growth assets. But, not all fixed income investments are equal.

Government bonds are lower yielding than TDs because they have even lower investment risk. They also dominate key Australian indices that fixed income managed funds and ETFs benchmark against. If you own fixed income managed funds or ETFs, chances are you are already invested in low-yielding government bonds.

Higher yields than TDs, more predictability than ETFs

Corporate bonds sit just above TDs on the risk-return spectrum of investments. They are also capital stable, with predictable income and generally higher yields than TDs. There are a number of ways to access corporate bonds, including some bond ETFs and bond managed funds.

However, both managed funds and ETFs have a key limitation – they are perpetual investments that do not mature. This is important for two reasons:

You are unable to predict future income.

You have no guarantee of return of capital.

With bonds held directly, you know today they’re going to mature at $100. The predictability of capital and income is a key reason for having fixed income in your portfolio in the first place.

XTBs provide access on ASX to senior bonds of S&P/ASX-100 companies. They are available over both fixed and floating rate bonds. They are a capital stable and predictable investment that you can access on ASX via your online broker, just as you do with shares. When the bond underlying each XTB matures, you get the face value of $100 back. Only the issuing company defaulting can change that. That’s the predictability and stability bonds can bring.

How they perform compared to TDs

Compared to government bonds, TDs or cash management accounts, XTBs provide similar steady and predictable income, but generally with higher returns. They can deliver greater returns than cash, with much lower risk than shares or hybrids. For example, you might get a return of 2.3% on your TD, but a portfolio of XTBs could provide 3% to 3.5%. That’s more than a 30% increase in income.

* Source: APRA Monthly Banking Stats June 2017

_800_533.jpg)