The $1.6 million threshold, announced in the 2017 federal budget, will limit the amount of super that can be transferred into a tax-free pension to produce income though retirement.

While amounts above the $1.6 million can still be withdrawn (or left in super’s concessionally-taxed 15% accumulation phase), the cap represents a new divide for retirees.

Australians will now need to ask themselves: will $1.6 million provide an adequate retirement income to underpin a comfortable lifestyle?

How long will it last?

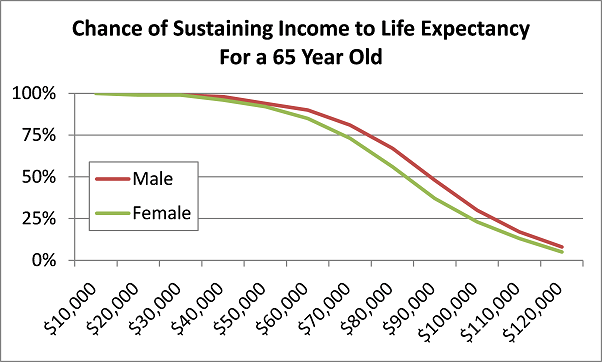

We’ve taken a hypothetical 65 year-old pensioner and estimated how long $1.6 million would last by drawing down a range of incomes.

Our calculations are based on a full range of probabilities across 10,000 scenarios using Milliman’s individual member analytic platform. This type of stochastic analysis tends to be an accurate way of assessing the outcome given highly variable factors, such as investment returns and the rate of inflation.

The diagram below shows that there is an almost 94% probability that $1.6 million will be enough to sustain a $50,000 annual income for a 65 year-old male retiree until life expectancy of 87. The probability declines slightly for 65 year-old female retiree because her predicted life span is slightly longer at 89[1].

Source: Milliman analysis. These results are hypothetical and have certain inherent limitations. Unlike actual results, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Assumptions: Income starts immediately and continues until funds run out. Target income is assumed to increase each year in line with CPI (which is assumed to vary in each scenario). SIS minimum withdrawal amounts are taken from the fund each year, if higher than the specified income drawdown amount. Funds are invested in a balanced fund (apx. 60% growth assets and 40% defensive assets) charging 1% annual fees. Models have been set up to use Milliman’s standard real-world stochastic model setup as at 31 March 2016.

This is enough to support a comfortable lifestyle according to ASFA’s Retirement Standard.

ASFA estimates that an annual income of $43,184 (at December 2015) is enough to support a single retiree comfortably while $59,236 is enough to support a couple (however, this may be an issue if one partner holds all – or the bulk of – retirement savings in their account under the $1.6 million cap).

This estimate is far from perfect and many individuals will expect more in retirement but it does give retirees a starting point.

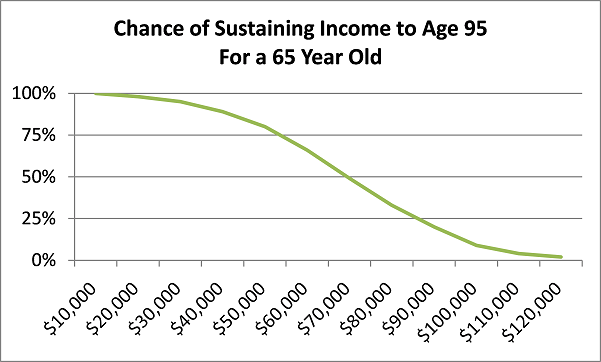

But what about the half of people who live longer than life expectancy? The chart below shows the chance of sustaining income to age 95.

Source: Milliman analysis. These results are hypothetical and have certain inherent limitations. Unlike actual results, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Assumptions: Income starts immediately and continues until funds run out. Target income is assumed to increase each year in line with CPI (which is assumed to vary in each scenario). SIS minimum withdrawal amounts are taken from the fund each year, if higher than the specified income drawdown amount. Funds are invested in a balanced fund (apx. 60% growth assets and 40% defensive assets) charging 1% annual fees. Models have been set up to use Milliman’s standard real-world stochastic model setup and calibration as at 31 March 2016.

This longer lifespan lowers the probability that a $50,000 annual income will last until age 95 to 80% (although ASFA also estimates that older retirees need about 10% less than younger retirees to fund a comfortable standard of living).

This is still a positive result.

In fact, a $70,000 annual income is still likely to be sustainable (i.e. better than a 50:50 chance of lasting to age 95).

While these calculations show that the new cap is unlikely to drag down the standard of living for most retirees, how does it stack up against the government’s own claim that $1.6 million is enough to provide approximately four times the single Age Pension: approximately $83,000?

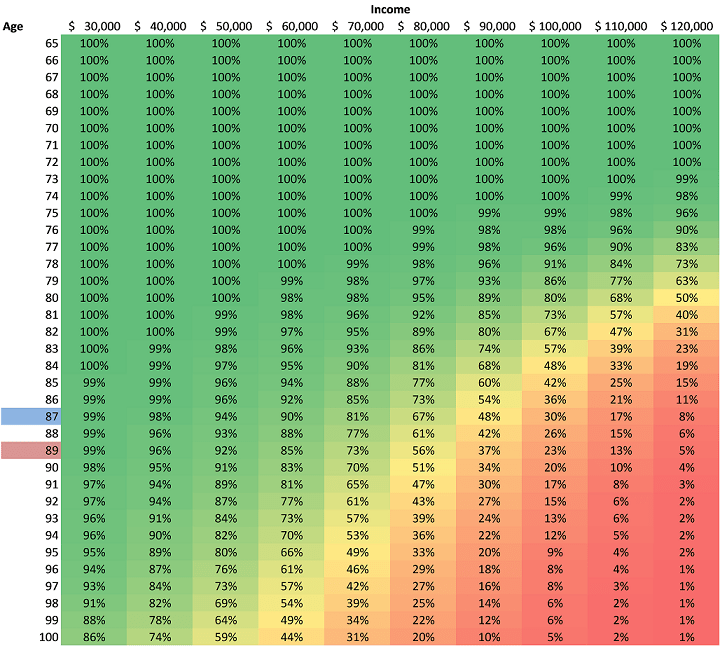

We now turn to a comprehensive summary showing a range of scenarios.

How long $1.6 million lasts depending on annual income

Source: Milliman Analysis. These results are hypothetical and have certain inherent limitations. Unlike actual results, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Assumptions: Income starts immediately and continues until funds run out. Target income is assumed to increase each year in line with CPI (which is assumed to vary in each scenario). SIS minimum withdrawal amounts are taken from the fund each year, if higher than the specified income drawdown amount. Funds are invested in a balanced fund (apx. 60% growth assets and 40% defensive assets) charging 1% annual fees. Models have been set up to use Milliman’s standard real-world stochastic model setup and calibration as at 31 March 2016.

The diagram above shows that the government’s claim is broadly accurate – up to a point.

An $83,000 annual income can be sustained to male life expectancy of age 87 approximately 70% of the time and there is about a 50:50 chance of sustaining this to female life expectancy of age 89.

Note that the modelling setup we use here takes into account the low levels of future returns implied by current record low interest rates.

Investors can still pull a range of levers (beyond expenditure) to change these probabilities and improve their retirement lifestyle. These include more sophisticated investment strategies such as specific management of sequencing risk and longevity protection.

While retirees will need to assess their positions after the raft of changes announced in the federal budget, the $1.6 million cap is unlikely to derail their retirement plans alone.

[1] Life expectancies have been calculated based on ABS Australian Life Table 2010-12 with future mortality improvements assumed at average improvement rates over the prior 25 years.

The article was first published on Milliman website.

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, and for other persons who are wholesale clients under section 761G of the Corporations Act.

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.

© 2016 MILLIMAN PTY LTD