The rise of goals-based financial advice has brought with it a vast range of new customer engagement tools – and big promises.

The hope is that sophisticated online tools and calculators, backed by high-level actuarial modelling, will reveal a client’s financial future and help change their behaviour.

The reality is that many of these “outcome engines” fall down in specific areas, which undermines their accuracy and ultimately erodes the confidence of clients.

But savvy financial services companies weighing up the latest tools being launched onto the market can sidestep some of the risks by considering these common pitfalls.

Integrated and interconnected

Outcome-oriented tools represent a significant investment and should be deeply integrated into a business if companies want to maximise their value. This integration should extend to underlying components, which can be shared across multiple applications ensuring that all advice (including traditional customer projections and simpler calculators) is consistent and based on current assumptions and regulatory settings.

Integrated solutions shared across multiple tools offers several advantages, such as:

Providing a single source of truth for all calculations, which reduces regulatory risks

Cost savings by re-using a central engine, allowing the business to focus on adding value to the user experience

Retiring outdated models (“our old actuary provided us with this model in 1998”), old data and assumptions, or a wide variety of piecemeal and unsupported online calculators and tools.

Scale

The ability to crank up large scale simulations across a large customer base should be a given. However, we often see unacceptable trade-offs which favour smart models where the focus has been on the technical modelling aspects, often with no consideration for the technology backbone required to support it (or vice versa). Combining technical excellence with a robust technology platform offers the best of both worlds: a robust analytical framework with an institutional technology stack.

Timely results

Tools need to be capable of running quickly enough to provide real time results – even for sophisticated modelling. For example, the traditional view is that Monte-Carlo simulation methods are too complex to produce real-time results without introducing significant shortcuts.

This is no longer true. Thanks to dedicated hardware and highly optimised code, these simulations can be run drastically faster. For example, graphic processing units (GPUs), combined with suitably optimised code, can perform calculations 40 to 50 times faster than conventional CPUs. Such speed increases can be the difference between simulations needing several seconds to run or just fractions of a second – the difference between a terrible user experience and a seamless one.

Communication

Having the smartest models in the world is worth little if the message is lost in a jumble of numbers. Tools and calculators need to seamlessly integrate their results into a simple and easy-to-digest format – a point all too often missed by the more technically oriented creators of some tools. In our experience, technical experts working in conjunction with marketing and communications professionals leads to a better and more insightful member experience.

Managing complexity

Modern technology allows for an awe-inspiring number of calculations. Do I need to model the tail risks associated with my customer’s key investments? Almost certainly. But what about modelling 487 different asset classes to get a realistic picture of that customer who fancies himself as an emerging markets structured bond option day trader? Almost certainly not. Do enough while retaining the flexibility to run more complex scenarios only when necessary.

Reveal the reasons behind results

With more complex models and tools comes a need to understand and communicate often seemingly counterintuitive results. Explaining the “whys” should be just as important as presenting the results.

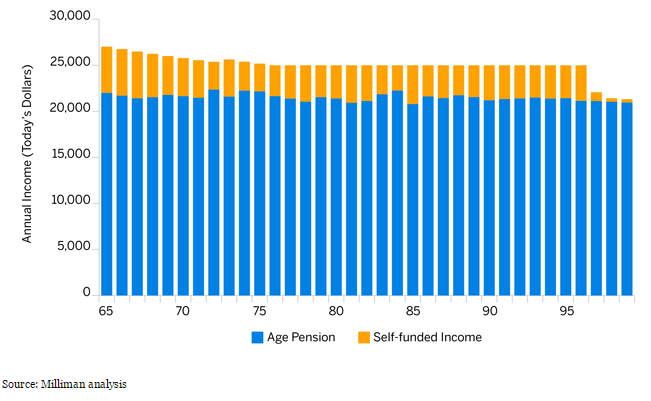

Stochastic simulation models provide a perfect example: an analysis might show that a client has a 95% chance of meeting his retirement income needs. While this might sound like the client is in a wonderful position, a deeper dive into the reasons for this might suggest a very different picture: the needs are very low and the user is almost entirely dependent on the Age Pension (see diagram below). Any regulatory changes to the Age Pension may be devastating and seeking greater financial independence may be advisable.

Figure 1: Source Of Income After Retirement - 10% Bad Case Investment Scenarios

Accuracy

Modelling shortcuts can help produce timely results but not at the expense of critically important data points. There are many examples in recent history of clever mathematical models leading to real-world chaos once those approximations have been dismissed or forgotten. The Australian Age Pension represents another common example where complex dynamics are all too readily assumed away in order to create a “neat” mathematical solution.

Know your customers

We live in a digital age, where customer data is the prevailing currency of the time. Sophisticated goals-oriented models and tools should reveal more information about your entire customer base while also increasing the value they receive. For example, key services that goals-based tool builders should be considering include:

- Refining customer projections and predictions regularly and automatically

- Analysing customer outcomes across the entire client base

- Monitoring and actively managing the potential ways customer outcomes change over time

- Tracking which online tools customers are using

Platforms sitting behind these modern analytic tools have the ability to gather plenty of information about how customers are using them. This data should be used to provide better functionality, which helps businesses refine and enhance the user experience.

A new wave of online financial advice and engagement tools is rapidly emerging with increasingly sophisticated underlying models and predictive capabilities.

Ensuring the correct build, design and purchase decisions are taken when developing this next generation of tools is critical to ensuring their longevity and continued success in a rapidly changing space.

The article was first published on Milliman website.

Milliman provides industrial-strength modelling capabilities to drive online advice tools (including next generation robo-advice tools), customer engagement tools and modelling of customer outcomes, customer segmentation and strategic product and proposition development.

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.