With belts tightening and uncertain economic conditions ahead, investors are increasingly asking advisers about new ways to boost their income. If you’re thinking about adjusting how you view your clients’ share portfolios with an income lens, there are some important filters to keep in mind (and a few stock ideas to consider).

As cost-of-living pressures begin to hit home for many Australians, fears of a recession in the US rise. Debt ceiling negotiations, also in the US, caused global market selloffs. Many investors are simply selling stocks in order to utilise the cash to cover the increasing cost of living. Back home, Aussies are dealing with high inflation and many are sitting on the side lines to avoid market volatility and a perceived fall in equity markets.

However, many are also looking to advisers for another strategic alternative to reduce the risk in their portfolios without cashing out completely… investing in income stocks.

Income stocks are companies that offer regular, steady income, in the form of dividends, over a consistent period of time. These companies have existing cash flows and therefore carry less risk than companies that are yet to establish stable cashflows from a genuine demand for their products or services.

While we have witnessed some companies press pause on dividends during the May reporting period, others are prioritising payment to investors who have stayed the course.

Income investing tip:

When investing in income stocks, consider whether company dividends are franked or unfranked. About 80% of the dividends paid by S&P/ASX200 stocks are fully-franked and this may help to reduce further tax obligations of shareholders receiving these dividends depending on your clients’ individual circumstances.

Income investing is a strategy gaining attention in 2023 as market volatility and the uncertain macro-economic outlook weighs on investor sentiment and desire to invest. While high growth investing was the trend of 2020 when interest rates were low and risk appetite was strong, we have seen the transition out of growth and into dividend/stable income investing in 2023.

Factors to consider when income investing in the stock market

When considering an income investing strategy, it is important to remind your clients about a few key factors:

- Dividend yield; whether yield is increasing or decreasing against share price and income year-on-year,

- The history of dividend payments, i.e. whether a company is consistent in paying dividends or whether the dividend was a one-off ‘special dividend’, and

- The potential to miss out on high-growth leaders given dividend-paying companies are not usually high-growth leaders.

Therefore, which companies are standing out as dividend-paying, stable investment decisions in 2023 for you to consider for your clients’ portfolios?

We know the obvious big blue-chip companies like BHP, Rio Tinto, Woodside Energy and the big four banks. But why not consider the lesser known, consistent dividend-paying stocks that may or may not have crossed your radar in recent times?

Stocks ideas to consider as part of an income investing strategy

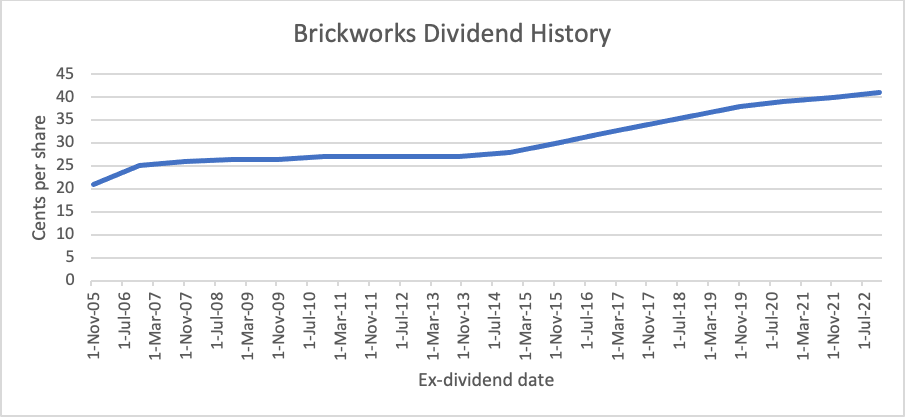

Brickworks (ASX:BKW) boasts one of the best dividend-paying track records on the ASX, having not missed or cut a dividend since the late 1980s. Given Brickworks has such a diverse earnings base it is able to weather tough economic conditions and downward trends in economic cycles, in a perfect example of why diversified operations can be a strong value proposition. The dividend yield for Brickworks as at 1H23 is 2.35% fully franked.

Source: IRESS

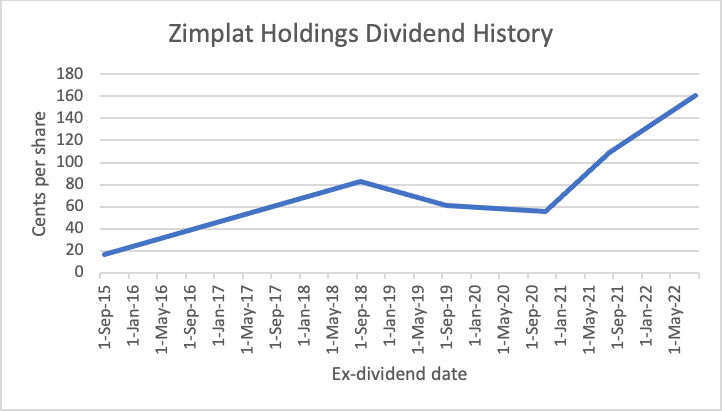

Zimplats Holdings (ASX:ZIM) has a dividend yield of 12.34%, have paid a dividend consistently since 2021. The dividend is unfranked and the one thing to consider with Zimplats Holdings is the very low volume trading given the majority shareholder, Impala Platinum Holdings, owns 87% of the company.

Source: IRESS

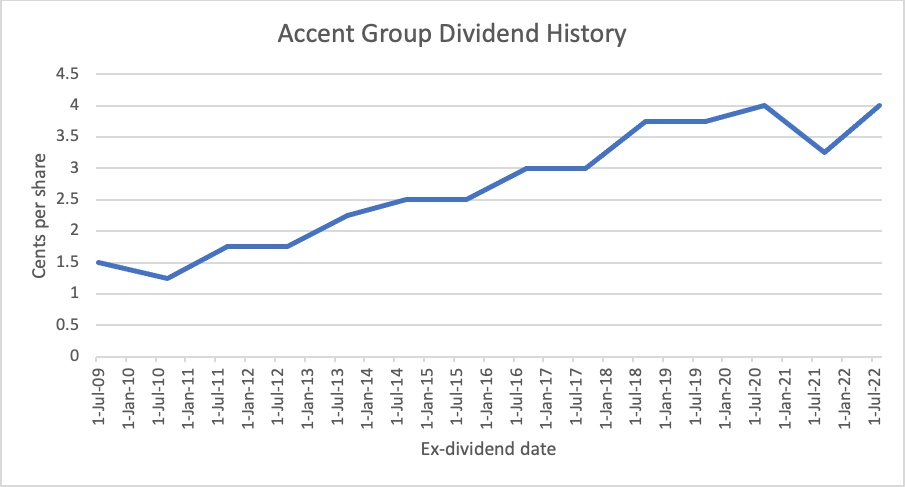

The Accent Group (ASX:AX1) is one name in the consumer discretionary sector that is thriving despite tough headwinds facing the broader sector. Retail spend on discretionary goods is falling and as a result, investors are very cautious on companies carrying high inventory levels or companies that are facing a material slowdown in like-for-like sales. The Accent Group has high turnover, like-for-like sales are up 16%-24% in 2H23 so far, and the company’s dividend increased significantly from 1H22 of $0.025/share to $0.12/share in 1H23. It is also important to note that AX1 has paid a consistent dividend since 2011, with special dividends included from 2005-2009, which is a significant inclusion given the company forms part of the consumer discretionary sector which, which as the name suggests, rides the retail cycle with uncertain demand during tougher economic times. Looking at the yield, Accent Group has a dividend yield of 10.24%, with the last dividend paid of 12cps up significantly from the prior corresponding half of 2.5cps.

Source: IRESS

Income investing tip for advisers:

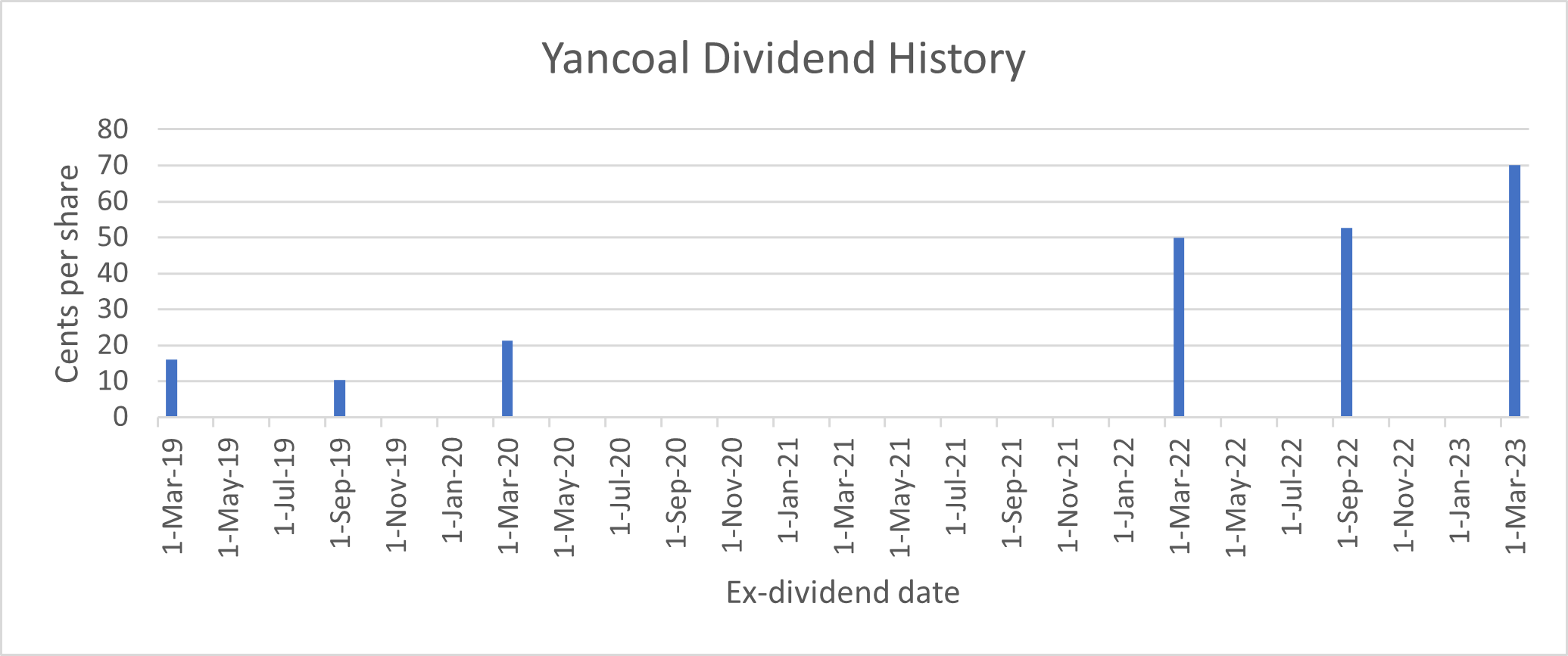

When looking at dividends it is important to consider the company’s long-term average. Be careful of an increasing dividend yield in relation to a company’s falling share price as this may indicate the historical dividends are now unsustainable. Additionally, look to analyse a company’s one-off payments based on the sale of an asset as this may increase yields based on a one-off event. These events are often referred to as ‘dividend traps.’

Yancoal (ASX:YAL) could be an easy trap to fall in when income investing given its 25% dividend yield, however when looking at concentrated mining companies it is important to remember their volatility and movement in performance is aligned with movements in commodity prices. Yancoal is the classic example of this. When the price of coal is rallying, i.e. in 2022 when the global energy crisis emerged following Russia’s invasion of Ukraine, the price of coal surged as countries turned to this commodity for energy as Russia’s exports dried up amid sanctions placed on the region. The surge in coal boosted Yancoal’s share price to rocket 127% over 2022, which prompted the coal miner to reinstate its dividend from Q1CY22, but the dividend is not consistent and may sit at 25% right now, but pays only $0.70/share. When it comes to income investing, consistency is key.

Source: IRESS

Other ways to embark on income investing for your clients in 2023

Advisers understand that a diversified portfolio of dividend or income paying stocks can help mitigate cost of living pressures currently hitting hip pockets in this high inflationary environment. Investing in companies that can more easily pass on input costs to customers due to inelastic demand may also reduce overall portfolio risk.

Another way to invest in high yield Australian stocks is through the Vanguard Australian Shares High Yield ETF (ASX:VHY) which offers low-cost exposure to companies listed on the ASX that have higher forecast dividends relative to other ASX-listed companies. VHY is up over 10.34% over the last year and is up 15.85% over the last 5-years, with the ETF offering exposure to companies like the blue chips including BHP Group, the big four banks, Telstra, and Macquarie while also providing investment in Lottery Corp, Incitec Pivot, Iluka Resources, Eagers Automotive, AMP, Elders, Nickel Industries and Tabcorp.

Income investing is a strategic move in the uncertain economic times we are all faced with, especially with the high prospect of a recession is the US on the horizon in the not-so-distant future.

Desktop Broker is an Australian-owned trading platform for advisors that's been around for 15 years and is part of the Bell Financial Group. That's solid ground for your business to grow.

This information is general in nature only and you should consider whether it is appropriate for you. For more information, visit desktopbroker.com.au or call 1300 786 199. Desktop Broker is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.

-min_800_899.jpg)